What does it mean to practice impact investing?

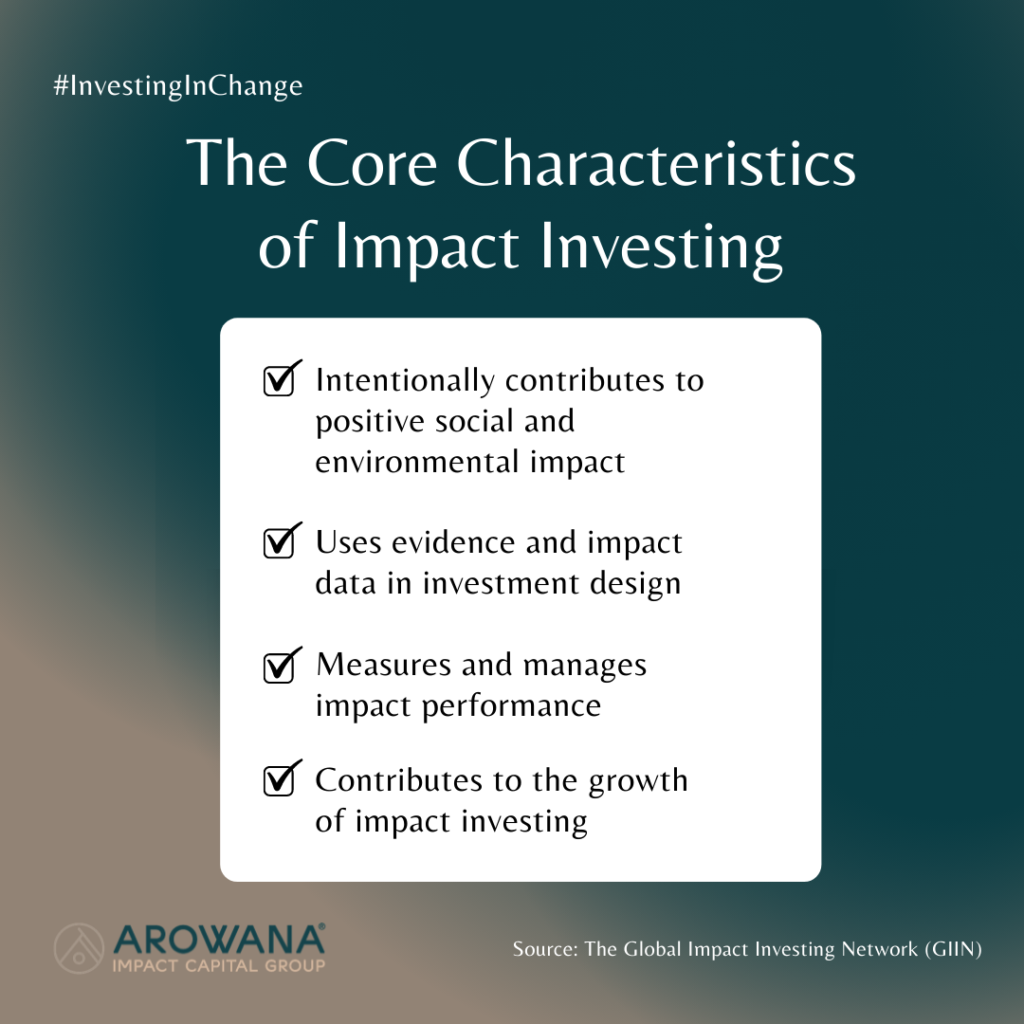

The Global Impact Investing Network (GIIN) has laid out the core characteristics that constitute impact investing. These characteristics, informed by a decade of work and research with global investors, outline the steps towards developing a rigorous impact investment practice. These are the same principles and approaches that guide Arowana Impact Capital towards making meaningful and credible impact investments.

1. Set intentions and impact targets.

Investors have varied reasons for pursuing impact investing, whether it is central to their mission as a company, a part of their commitment as a responsible investor, or an efficient approach to achieve their impact targets. Across the board, however, impact investors intentionally finance solutions to various social and environmental challenges.

This intentional desire to contribute to measurable social and environmental good is at the core of what makes impact investing different from other investment approaches. GIIN adds that prior to starting an impact investment, one must answer three key questions, namely:

1. What types of impact do I seek?

2. What are my financial return expectations?

3. How do I allocate my assets?

2. Design investments based on evidence and impact data.

The best way to identify a pressing social or environmental need is to align with the latest research and data, as well as with the calls to action from relevant communities and organisations. Using the best evidence available allows investors to set targets and design investment strategies that can best address these needs, thereby increasing their contribution to positive social and environmental impact.

At Arowana Impact Capital, we incorporate technology and data analytics at every stage of our sustainability planning and impact investment framework. This allows us to connect data and insights to real-world impact and translate our ideas into meaningful actions. By improving our ability to analyse our impact, we also improve the thoroughness of our investment activities over time.

3. Measure, manage, and optimise impact performance.

Impact measurement and management is a hallmark of impact investing. This can be done by aligning with global frameworks and assessments, such as the Global Impact Investment Rating System (GIIRS), the Global Reporting Initiative (GRI), and the Sustainability Accounting Standards Board (SASB), among others. Investors may also align with the metrics of IRIS+, a globally-recognised system to measure, manage, and optimise impact.

Most impact investors also monitor and measure the performance of their investments against the Sustainable Development Goals of the United Nations (UN SDGs), a shared global blueprint and call to action for achieving peace and prosperity for people and the planet by 2030.

In impact investing, financial returns will always be part of performance measurement. And while impact investors target a wide range of financial returns, depending on the industry and asset class, most pursue risk-adjusted, market-rate returns on their investments.

4. Allocate assets wisely and contribute to the growth of impact investing.

To date, there are more than 1,720 organisations involved in impact investing globally, managing assets worth around US$715bn, according to the 2020 Annual Impact Investor Survey of GIIN.

Indeed, the possibilities are endless as impact investing is not limited by geography, industry, or asset class. In fact, impact investors target a wide range of sectors that need financial backing, such as energy, microfinance, housing, food and agriculture, infrastructure, healthcare, and education.

With offices in Australia, Singapore, and the Philippines, Arowana Impact Capital intentionally focusses on four key impact areas, namely: (1) livelihood creation, (2) access to education and healthcare, (3) sustainable urbanisation, and (4) financial inclusion. We also contribute to the growth of the industry by sharing our insights and best practices, where possible, to empower others to learn from our experiences in impact investing.

We at Arowana Impact Capital continue to be intentional with our impact investments. We remain committed to growing enterprises whose principles and practices align with our vision of sustainable development to advance social and environmental good.

This is the second article in our series on impact investing. In the next instalment, we will explain the difference between impact investing and ESG investing.