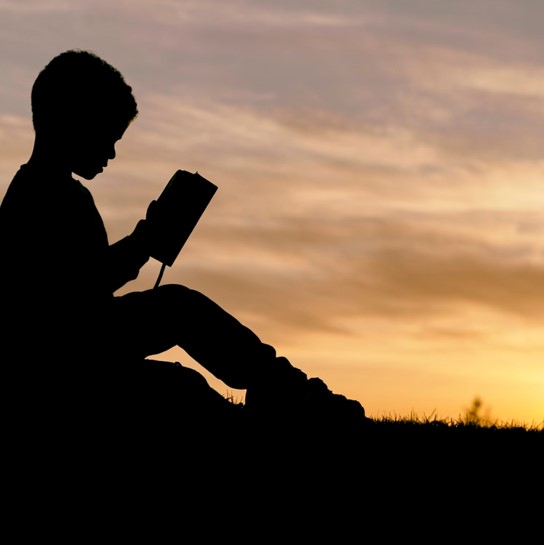

We invest to deliver sustainable impact in Southeast Asia.

Investment Mandate

In providing financial expertise and assistance to small and medium enterprises (SMEs), Arowana Impact Capital (AIC) aims to deliver sustainable impact in line with the UN’s Sustainable Development Goals (SDGs).

GOOD HEALTH AND WELL-BEING

QUALITY EDUCATION

GENDER EQUALITY

DECENT WORK AND ECONOMIC GROWTH

REDUCED INEQUALITIES

SUSTAINABLE CITIES AND COMMUNITIES

Responsible Consumption and Production

CLIMATE ACTION

A Shared Vision

AIC partners with SMEs who share our vision of sustainability and whose principles and practices align with ours. Together, we can reframe the biggest environmental and social challenges into growth and development opportunities.

Key Focus Areas

Now more than ever, we recognise how the consequences of all business decisions affect not only profit margins but also people and the planet. We acknowledge the importance of our actions, and we have chosen to collaborate with businesses who value long-term development in these areas:

Sustainable

Urbanisation

Livelihood

Creation

Education and

Healthcare

Financial

Inclusion

Geography

AIC aims to be the champion of impact investing in Southeast Asia. Our initial focus will be investing in high-growth, purpose-driven businesses in the following countries:

Philippines

Indonesia

Vietnam

Affiliations

In line with our mission to promote responsible investing, sustainability, and to help achieve UN SDGs, AIC supports the following organisations:

“In order to truly contribute to the achievement of these goals by 2030,

impact investors must raise and direct new capital to address

these pressing social and environmental problems.”

Global Impact Investing Network