Today, more people are increasingly concerned about environmental and social problems such as climate change, poverty, gender, and racial inequality, as well as data security and privacy. In line with this growing social awareness, investors are also keen to put their money where their mouth is by investing in companies that are aligned with their personal values and priorities.

There is a growing subset of investment options for these kinds of investors. One of them is ESG investing, which looks at a company’s financial performance in relation to its non-financial performance in the environmental, social, and governance (ESG) criteria. It is a strategy that allows you to invest in companies that strive to make the world a better place―or, at the very least, endeavour to do less harm to the environment and society.

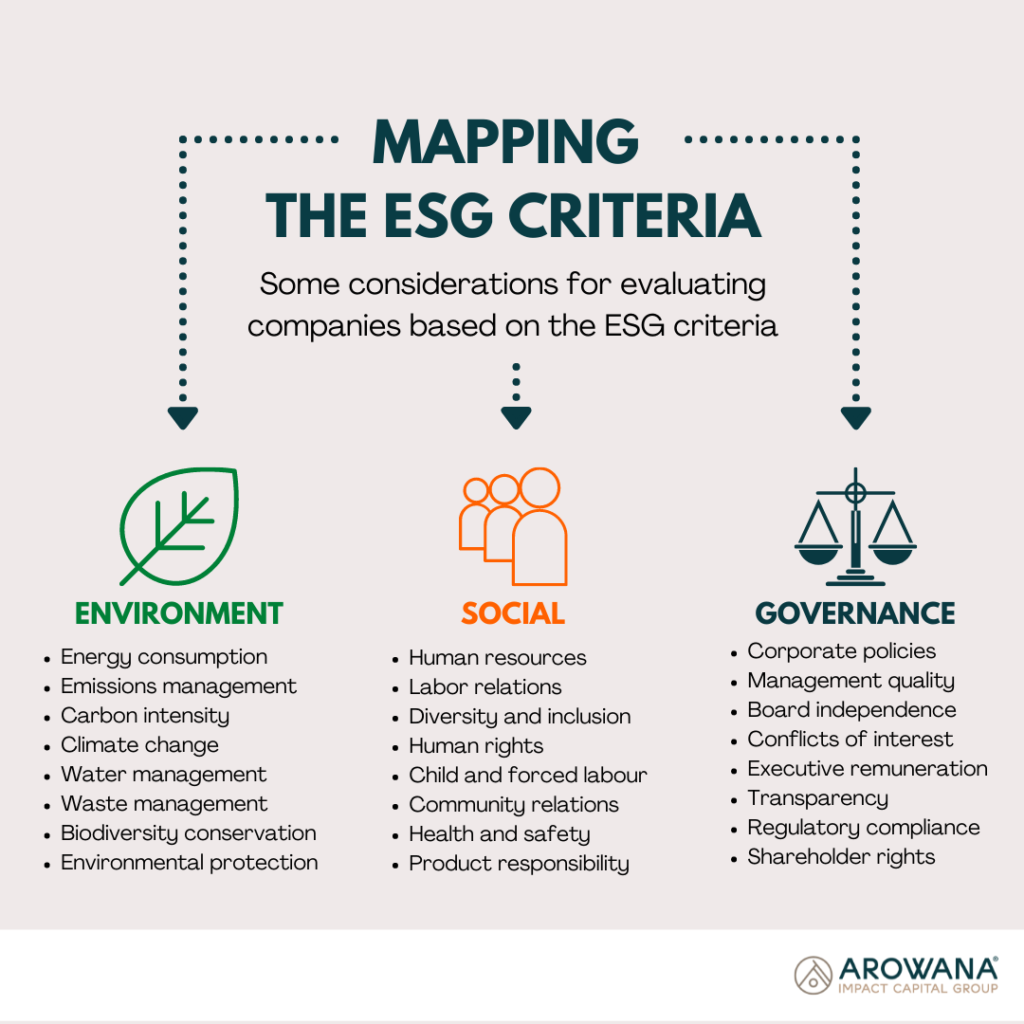

Breaking down the ESG criteria

Having an ESG criteria helps investors find companies whose values and priorities match their own. Today, many mutual funds, brokerage firms, and financial advisors offer investment products following an ESG criteria. Realistically, however, no single company will meet all the requirements of this ESG criteria. As such, investors must set priorities and decide which issues are most important to them.

Environmental. This criterion looks at how a company fares as a steward of the environment and natural resources. This includes an evaluation of a company’s energy use, carbon emissions and intensity, waste and effluents management, land and water use, natural resource and biodiversity conservation, as well as compliance with pertinent environmental regulations. A thorough evaluation of these material issues will reveal the environmental risks a company may be exposed to, which may inevitably impact their financial performance.

Social. This criterion looks at how the company manages its relationships with different stakeholders, namely, its employees, suppliers, customers, shareholders, and communities. Under this criterion, there is an emphasis on whether different stakeholders are consulted on and engaged with, especially with regards to business decisions that may impact them, and whether their interests and well-being are considered in the decision-making process. Fostering harmonious relationships with different stakeholders strengthens a company’s social license to operate, which bodes well for financial performance and business sustainability.

Governance. This criterion looks at the quality of the company’s leadership and management, as well as how it handles shareholder rights, executive pay, audits, and internal controls, among other considerations. Investors want the assurance that the company does not engage in illegal activities or condones conflicts of interest. Additionally, a company may be evaluated based on the comprehensiveness of their policies, and whether these also address environmental and social concerns.

ESG and financial performance

Given the extent and complexity of these criteria, ESG investing relies heavily on the independent ratings determined by third-party evaluators and research groups. These independent ratings give investors a better view of a company’s environmental impact, social outcomes, and governance issues.

As in impact investing, there is a prevailing misconception that ESG investing does not yield substantial financial returns. However, research from the CFA Institute suggests that “systematically considering ESG issues will likely lead to more complete investment analyses and better-informed investment decisions.â€

Indeed, integrating an ESG criteria serves to enhance traditional financial analysis by identifying potential risks and opportunities. While environmental and social impact underpin ESG investing, yielding financial returns is still part of its goals. As such, a thorough ESG valuation helps investors avoid companies whose practices pose a greater financial risk.

Given the pace at which environmentalism and social consciousness now steer government and business decision-making, ESG investing will only continue to grow. According to the latest report from the US SIF Foundation, in the US alone, investors held US$11.6tn in assets chosen based on ESG criteria at the beginning of 2018, a 43.2% increase from US$8.1tn in 2016.

We at Arowana Impact Capital remain committed to growing enterprises whose principles and practices align with our vision of sustainable development to advance social and environmental good.

This is the third article in our series on impact investing. In the next instalment, we will explain the difference between impact investing and socially responsible investing (SRI).